how much state tax do you pay on a 457 withdrawal

Nonperiodic distributions from an employers retirement plan such as 401 k or 403 b plans are subject to withholding for federal income tax at a flat rate of 20. 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Deferred Compensation County Of Fresno

The current state marginal tax rate you.

. If you have a 457b you can withdraw the budget from your account without any early withdrawal penalty. However distributions received after the pensioner turned 59 12 would. 457 Plan Withdrawal indicates required.

State Tax Withholding for Qualified Plans MPPPSP403b401k457b Effective 3302020 Below are the state tax withholding requirements which will be withheld from any distribution. How do 457b plans work. Withdrawal Rules for a 457b Account.

The current state marginal tax rate you expect to pay on any additional income or taxable distributions. One of the most well known rules when it comes to the TSP is the rule of 59 and ½. Use this calculator to see what your net withdrawal would.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. This entry is required. You can withdraw your money from 457 before age 59½ without a 10 penalty unlike a 401k but you will owe taxes on any withdrawal.

Amount to withdraw. Can you withdraw money from 457b. If you do not wait until the age of 59-12 to withdraw your 401 k funds you may pay a penalty tax in addition to federal state and local taxes.

How Withdrawals Work. In most circumstances an early. 457 Plan Withdrawal Calculator Definitions.

Its a permanent withdrawal from your TSP account. However if you save on the 403b you will receive a 10 penalty on. Enter an amount between 0 and.

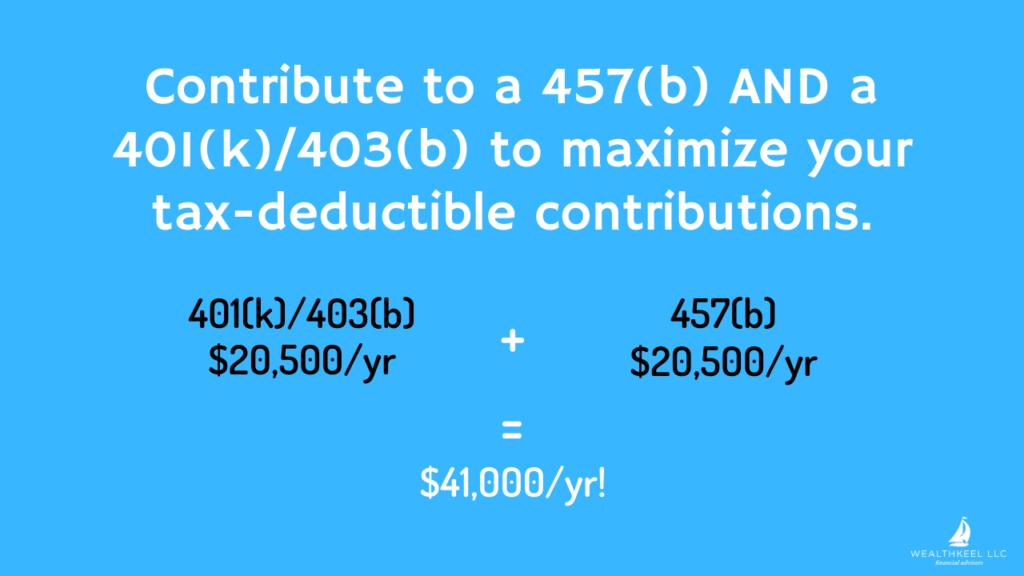

So if you have the option of a 401 k and a 457 and youre under the age of 50 you can contribute up to 38000 a year between the two plans. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. Basically any amount you withdraw from your 401 k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return.

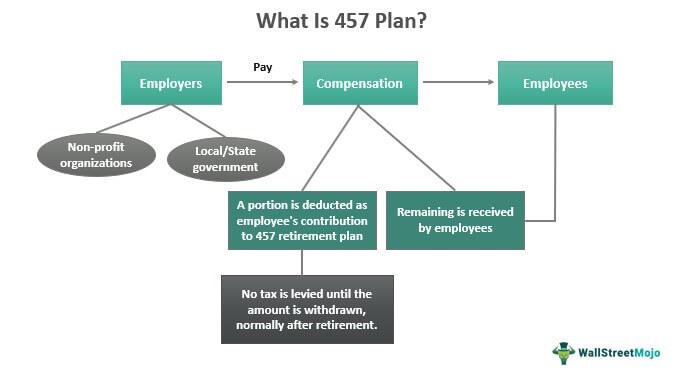

A 457b plan is a tax-deferred retirement savings plan that lets you defer part of your wages and save them for retirement. Employers or employees through salary reductions. If you have a governmental or non-governmental 457 b plan you can withdraw some or all of your funds upon retirement even if you are not yet 59½.

You cant put the money back. The organization must be a state or local government or a tax-exempt organization under IRC 501c. For example if you fall in the 12 tax.

Press spacebar to hide inputs. However if you withdraw from. Are distributions from a state deferred section 457 compensation plan taxable by New York State.

457 Plan And Cryptocurrency Bitcoin Rollover Options Bitira

457 B Vs 401 K Plans What S The Difference Smartasset

What Is A 457 B Plan How Does It Work Wealthkeel

A Guide To 457 B Retirement Plans Smartasset

Irs Form 1099 R Box 7 Distribution Codes Ascensus

457 Plan Meaning Retirement Plan Benefits Limits Vs 401k

457 Deferred Compensation Plan White Coat Investor

Does Illinois Require You To Pay State Taxes On An Ira Withdrawal

How Much Tax Do I Pay On 401k Withdrawal

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

How A 457 Plan Works After Retirement

457 Deferred Compensation Plan White Coat Investor

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

How Can I Get My 401 K Money Without Paying Taxes

457 Deferred Compensation Plan White Coat Investor

Publication 575 2021 Pension And Annuity Income Internal Revenue Service