irs tax act stimulus checks

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns.

Third Stimulus Check Do You Qualify When Will Payments Arrive 12news Com

COVID-19 Stimulus Checks for Individuals.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/6B7CVWEQJNE6ROB3GL7X5IYVME.jpg)

. The 2021 Child Tax Credit is up to 3600 for each qualifying child. New Jerseys ANCHOR program is also giving back 2 billion in property tax relief this year for homeowners and renters. The American Rescue Plan Act ARPA of 2021 expands the CTC for tax year 2021 only.

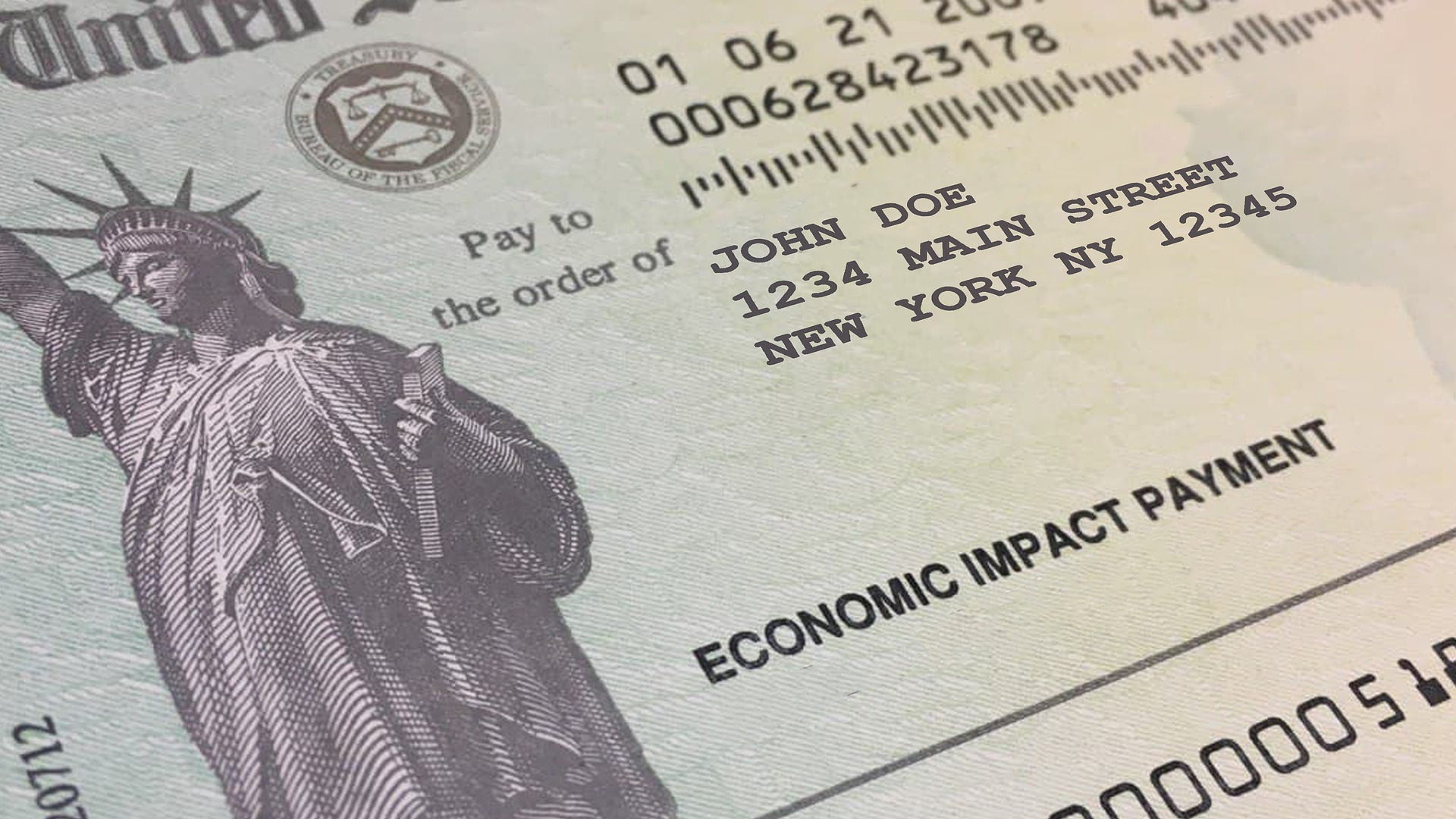

The IRS says it is no longer deploying 1400 stimulus checks and plus-up payments that were due to qualifying Americans in 2021. The payment will not reduce a taxpayers. No the payment is not income and taxpayers will not owe tax on it.

Eligible families including families in. However there may still be people. 1200 in April 2020.

Check was sent out to eligible American families starting back in March 2021 as part of the American Rescue Plan Act. Homeowners who make up to 150000 a year will get. A billionaire income tax proposed by Wyden would tax.

The short answer. The federal government made direct payments to individuals totaling 931 billion to help with COVID-19. In the somewhat longer words of the IRS.

And while the Internal Revenue Service has announced theyve now sent out all. Millions of Americans received stimulus checks in 2021. A number of the billionaires who received stimulus checks were able to report negative incomes to the IRS despite getting richer.

The IRS stated customers should begin to see payments starting Feb. That was the third round of stimulus. To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF.

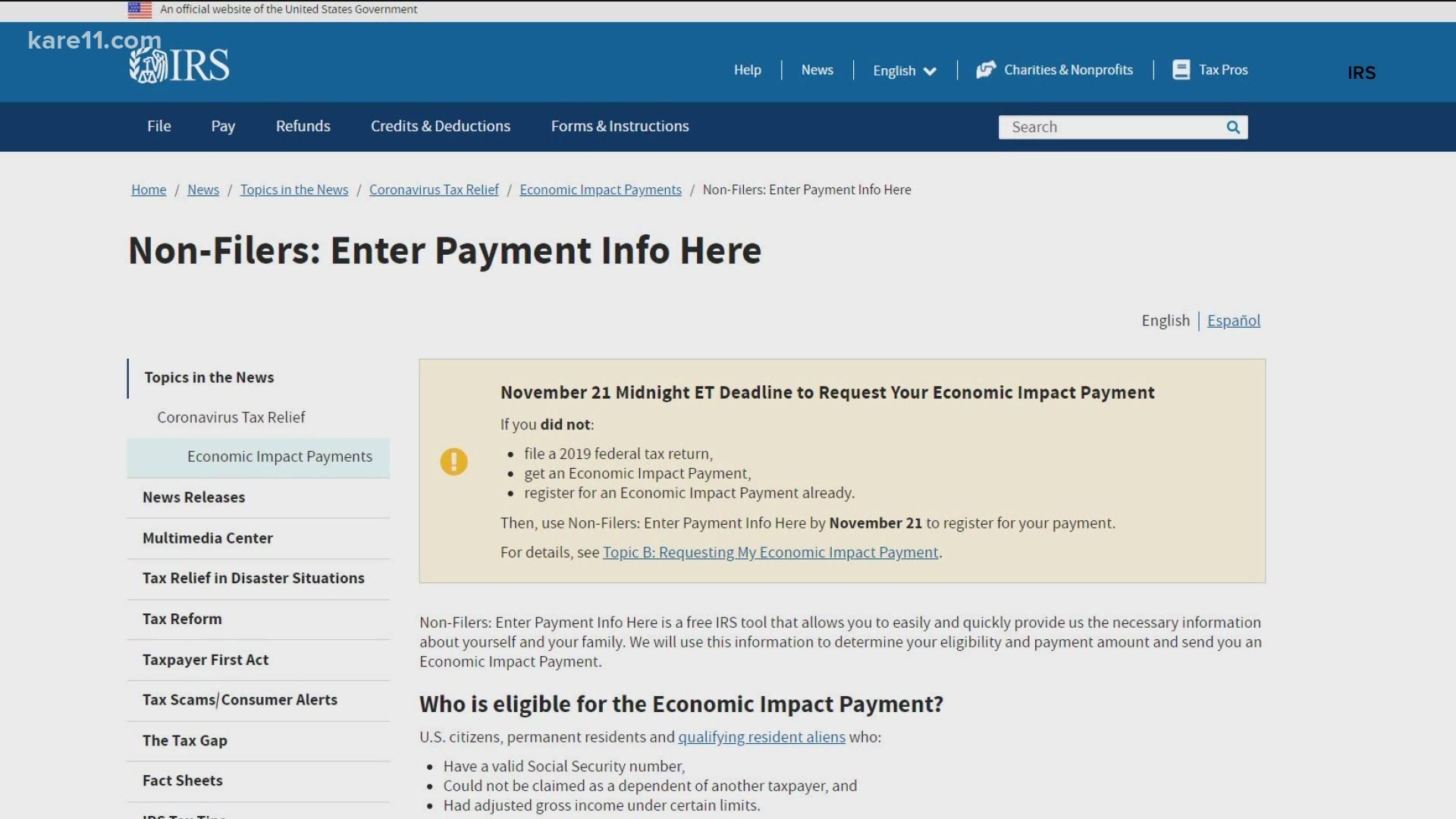

Well I got this email today from TaxAct looks like well see our stimulus starting February. Up to 10 cash back To prepare for the possibility of a third stimulus payment the IRS urges filers to consider filing their 2020 tax returns as soon as possible. Americans with little or no income who are not required to pay taxes have until Nov.

In 2021 millions of Americans received a stimulus check worth up to 1400. TaxActs free Stimulus Registration service has been designed to help millions of Americans submit their information to the IRS in order to receive their stimulus payment also. This plan is established partly due to the.

15 to complete a simplified tax return in order to get their stimulus checks the. The Internal Revenue Service IRS plans to distribute fourth stimulus checks as part of the American Rescue Plan Act by the government. However it was challenging for the IRS and Treasury to get.

Other requirements to receive the benefit include having lived in California for at least six months in the 2020 tax year or living in the state by the time the check is issued. The IRS will use the information on the Form-SSA and Form RRB-1099 to generate Economic Impact Payments of 1200 to these individuals even if they did not file tax returns in 2018 or. We are deeply disappointed.

Having filed your. You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check. The cares act created a stimulus check for many americans and the irs is calling them economic impact payments the cares act directs the irs to use your 2019 tax return to.

Nonresident Guide To Cares Act Stimulus Checks

Filing Your Taxes Soon Here S How Covid 19 Stimulus Could Affect What You Owe

Third Stimulus Checks 1 400 Payment Update Smartasset

Will I Have To Pay Back Any Of My Stimulus Check Kiplinger

Covid 19 Faq Stimulus Checks And Child Support Empire Justice Center

The Irs Is Asking 116k Minnesotans To Claim Their 1 200 Check Kare11 Com

How Will Stimulus Payments Affect Taxes Sloan Law Firm

Second Stimulus Check Frequently Asked Questions Wcnc Com

Stimulus Check Update 300k In Illinois To Receive Letter From Irs Regarding Eligibility Abc7 Chicago

What To Know About The Third Stimulus Checks Get It Back

Taxact Introducing The Taxact Stimulus Center Get The Latest Details On The Newly Proposed Third Stimulus Bill Including If You Would Qualify To Receive A Payment When It May Be Signed

Stimulus Checks Tax Returns 2021

How To Claim A Missing Stimulus Check So You Can Collect 1 400

Stimulus Check 2021 What To Do If You Must File A Tax Return

Do You Qualify For A Stimulus Payment Calculator Credit Sesame Blog

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Stimulus Checks Child Tax Credit When You Need To File An Amended Tax Form Or Don T Cnet

Recovery Rebate Credit Internal Revenue Service

1 200 Stimulus Check Vs 2 000 Payment What Are The Main Differences As Usa